Only local buyers left in the Lithuanian investment transactions market

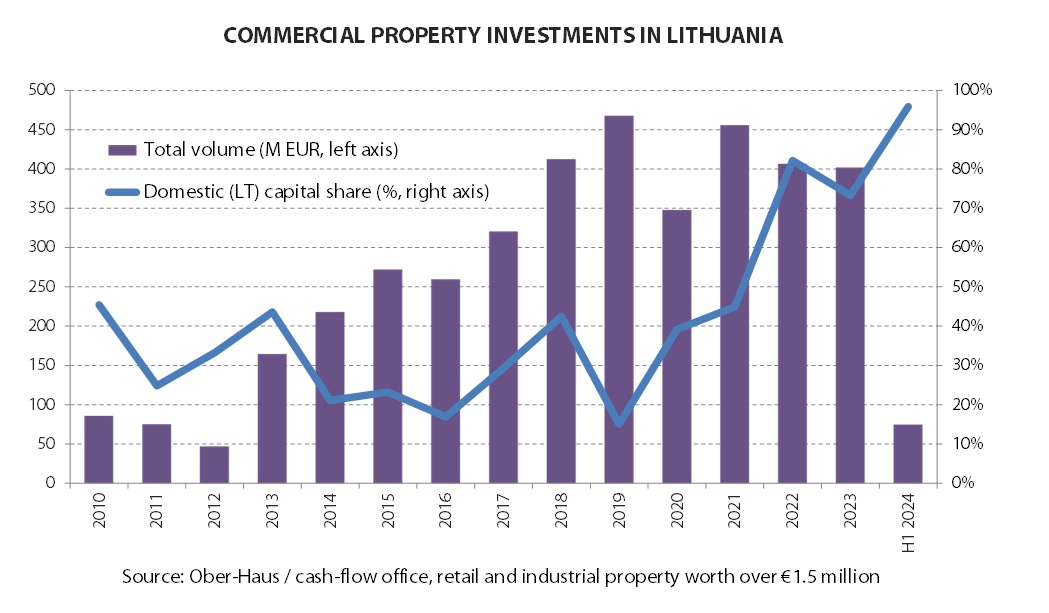

Optimism continues to be hard to find in the Lithuanian commercial real estate investment market, with overall performance falling to 10-year lows. “According to Ober-Haus, in the first half of 2024, EUR 75 million worth of modern flow commercial property (offices, retail, warehousing and industrial buildings and premises with a value of at least EUR 1.5 million) was acquired in Lithuania. The investment volumes for the first half of 2024 are 48% lower compared to the first half of 2023 and 71% lower compared to the second half of 2023. At the same time, the result for the first half of this year is the worst since the second half of 2013, according to the Ober-Haus review.

According to Raimonds Reginis, Research Manager for the Baltics at Ober-Haus, , the very significant percentage drop in investment volumes in 2024 was also due to the very high total result in 2023, which did not reflect the pessimistic mood prevailing in the property market in that year. And the higher than expected volume of investment transactions in 2023 is in fact due to one particularly large transaction.

At the end of 2023, it was announced that Baltic Opportunity, an investment company managed by Lords LB Asset Management, is acquiring six office buildings in Vilnius from Finnish company Technopolis (in 2018, London-based private equity real estate firm Kildare Partners agreed to acquire all of Technopolis shares). Technopolis entered the Lithuanian market in 2013 with the acquisition of 3 office buildings in the Ozo Park area and subsequently expanded its property portfolio in that area to 6 buildings with a total area of 106,000 sqm.

“The investment transaction was formally completed at the beginning of 2024, following the approval of the merger by the Competition Council of the Republic of Lithuania. However, given the factual circumstances, this transaction has been assigned to 2023 and can be said to have significantly changed the annual investment indicator in Lithuania”, says Reginis.

Although the details of the transaction were not disclosed, it is speculated that the value of this deal could have reached approximately EUR 200 million. In any case, this is the largest investment office transaction in Lithuania’s history, bringing the total volume of investment transactions in 2023 to EUR 402 million, only 1% less than in 2022 (EUR 406 million). Without this transaction, total commercial property investment in 2023 would have been twice as low, reflecting global trends that show commercial property investment in the main regions of the world contracting by around 50% in 2023.

In the first half of 2024, offices accounted for the largest share of investments

Meanwhile, the result for the first half of this year is modest and fairly accurately reflects the generally pessimistic mood in the real estate market. The investment transaction market has been dominated this year by small transactions, mostly in the EUR 3-6 million range. According to Ober-Haus estimates, the office segment accounted for the largest share of investments in the first half of the year with EUR 34 million, or 46% of total investments for the first half. The largest investment transactions of the half year were in this segment.

At the beginning of the year, real estate development company Eriadas, together with DIFF Develop, a closed-end investment company for informed investors, acquired the buildings of the headquarters of insurance company Ergo in Vilnius, Geležinio Vilko Street. Ergo plans to continue renting the premises from the new owners while looking for new premises for its employees. Meanwhile, the new owners of the buildings and land have plans for a new commercial and residential development on the site.

The largest transaction was completed in mid-2024, when the fund of the investment management company ZeroSum Asset Management acquired a complex of three office buildings in Vilnius, Švitrigailos street from the Norwegian company AMG Property. As the Norwegian company sold its previous properties in 2022, this was the last property in Lithuania it managed.

Investors focused on small format shops

In the first half of this year, the volume of investment in retail property acquisitions accounted for 34% of all commercial property investment in Lithuania. Although there were no major acquisitions in this segment, buyers were quite active in acquiring modern small format stores (1,500-2,500 sq m) located in large food chains.

There have been five such acquisitions in Lithuania in the last six months, with the largest deal initiated by supermarket chain Lidl, which agreed to sell four of its newly built stores to a fund managed by investment management company DIFF Assets. The acquisition of three stores was actually completed in the first half of this year and the acquisition of the fourth is expected to be completed in the second half of this year.

“Despite the noticeable stagnation in the investment property market, such properties remain popular among buyers. Strategically located supermarkets, which are operated by major retail chains, virtually guarantee a stable rental income stream for new owners and a tenant with an interest in continuity. For example, in just the past two and a half years, nearly 30 supermarkets of this format have changed owners in Lithuania”, says Reginis.

The remaining 20% of investment in the first half of this year was in the acquisition of warehousing and industrial properties. The largest transaction took place in Kaunas, where the fund of investment company Eika Asset Management sold a 5,600 sqm logistics building to pharmacy chain Camelia, which is leasing it.

Foreign investor activity shrinks to a minimum

The current mood in the country’s commercial property investment market is reflected not only in the amount invested or the number of properties acquired, but also in the origin of the investment capital.

In 2022-2023, a record increase in the share of local investors in the Lithuanian investment market was observed, indicating that foreign investors significantly reduced their investments in real estate in our country. In 2022, the share of capital owned by Lithuanians have increased to 82%, while in 2023, it accounted for 73%. In the first half of 2024, the share of local capital increased to 96%, showing that the market is essentially left to local investors. For example, from 2012 to 2021, the share of local investors in total investments was only 37%.

The range of profitability indicators is significantly wider

In an environment of extremely low volumes and low diversity of investment transactions, it is difficult to objectively assess changes in investment property yield in the first half of this year.

“Some of the transactions indicate that investors are still willing to pay record prices for their currently most attractive assets (e.g. supermarkets), but less attractive assets (older properties or properties with other uses) are being acquired at yields that are more attractive to buyers (at a lower price than before). It can be said that the yield spread has now widened significantly, meaning that overall commercial property yields have tended to rise slightly this year”, says Reginis.

Outlook for the second half of the year: passive investors and uncertain return of foreign capital

Looking at the results of the first half of this year and the general investment climate (especially investors’ expectations), it is unlikely that we can expect a surge in the number of investment transactions in the second half of the year.

According to Reginis, it is unlikely that there will be a return of foreign investors to our market this year, or any bolder decisions on the part of local investors. “However, technically at least, total volumes will not necessarily remain at the lows of the first half of this year. For example, one or more large investment deals can significantly raise the overall investment volume indicator (as we saw in 2023),” says an Ober-Haus analyst.

It should also remembered that in recent decades a number of property funds with a foreseeable life have been invested in commercial property. When the fund’s specified operating period ends (e.g., 5 years), the fund manager sells the real estate on the market and settles with the investors, or, if an agreement with the investors is reached, extends the fund’s operations for a certain period (e.g., 2 years). The commercial assets sold by the funds to be closed in the near future would provide a clearer picture of the overall liquidity of the property market and the value of these assets in the current environment.

Latest news

All news

All news

Housing market has woken up, but no faster price growth yet

The Ober-Haus Lithuanian apartment price index (OHBI), which follows changes in apartment sale prices in the five biggest Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys) increased by 0.4% in February 2025. The annual apartment price growth in the biggest cities of Lithuania was 4.1% (a 4.0% increase was recorded in January 2025). In February 2025 apartment prices in Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys increased by 0.3%, 0.1%, 0.8%, 0.8% and 0.9%, respectively, with the average price per square meter reaching EUR 2,670 (+7 EUR/sqm), EUR 1,822 (+2 EUR/sqm), EUR 1,754 (+13 EUR/sqm), EUR 1,168 (+10 EUR/sqm) and EUR 1,147 (+10 EUR/sqm). In the past 12 months, the prices of apartments increased in all the biggest cities in the country: 3.2% in Vilnius, 4.1% in Kaunas, 6.2% in Klaipėda, 6.6% in Šiauliai and 6.7% in Panevėžys. ‘As predicted, a rapid annual growth in the number of housing transactions is recorded at the beginning of 2025. According to the data of the State Enterprise Centre of Registers, 40% more apartments were purchased in the country in January this year and 39% more in February this year than in the same month in 2024. It should be noted that in the…

In 2024, Lithuanian investment transactions market slumped by 43%

The general sentiment in the Lithuanian commercial property market in 2024 is well reflected in the volume of investments, which has declined to the levels last seen in 2014. According to the data of Ober-Haus, in 2024, the value of modern cash-flow commercial property (modern office, retail and industrial objects with the value of at least EUR 1.5 million) acquired amounted to EUR 230 million. This means that the annual volume of investments declined by 43% compared to 2023 or 2022. ‘In 2024, only small and medium-sized transactions were recorded in Lithuania, whereas there had been no acquisitions of larger transactions at all. For the first time after a lengthy period, the value of the largest deal did not exceed EUR 30 million‘, said Raimondas Reginis, head of market research for the Baltics at Ober-Haus. According to Ober-Haus, deals up to EUR 10 million in value represented 40% of total investments in Lithuania, whereas deals valued at EUR 10–30 million – the rest (60%). Retail properties attracted the largest share of investments, with investors primarily focusing on supermarkets The largest portion of investments befell to retail properties with EUR 134 million or 58% of all investments in commercial property in Lithuania spent for acquisitions.…

Ober-Haus completes the sale of “Beržų namai” project

A. Juozapavičiaus Street, Kaunas, the last apartment in the project "Beržų namai" was sold, the concept of which was developed and successfully realised by Ober-Haus. All the apartments have already been occupied, and the completion of the project has become a significant event in the rapidly modernising Žemieji Šančiai district. Two apartment buildings have been designed on a plot of almost 0.43 hectares, with 72 two- to three-room apartments of 45-63 square metres. The project includes 41 underground and 32 above-ground parking spaces, bicycle storage and storage rooms, and a private courtyard. "From the very beginning of the sale, we have felt great interest from buyers - the reason for this is both its exceptional location and the lack of quality housing in Kaunas," says Svajūnas Šarauskas, Manager of the Kaunas office of Ober-Haus. The houses were built in the growing and rapidly changing Žemieji Šančiai district, in a quiet and green part of A. Juozapavičiaus Avenue. "Beržų namai has contributed to the development of the area by landscaping the environment, greening and fencing the yard, and installing a children's playground. "Beržų namai has not only added to the landscape of the modernising district, but has also encouraged the…

All news

All news